Bank Account Verification

Product overview

Bank Account Verification ensures that the client holds a bank account with a financial institution and verifies the account holder's name.

To facilitate this verification, the client transfers a small amount, typically 10 cents, to Fourthline via their own bank. We automatically match the international bank account number (IBAN) and account holder name provided by the client to the bank account used for the payment.

Fourthline provides a bulk payout of all received client funds over a defined period, along with the necessary information to reconcile payments in your system. You can either return the funds to the client's original account or credit them to a newly opened account.

Use Bank Account Verification as part of your Identity Verification solution, together with Qualified Electronic Signature, to support a BaFin-compliant onboarding flow in Germany.

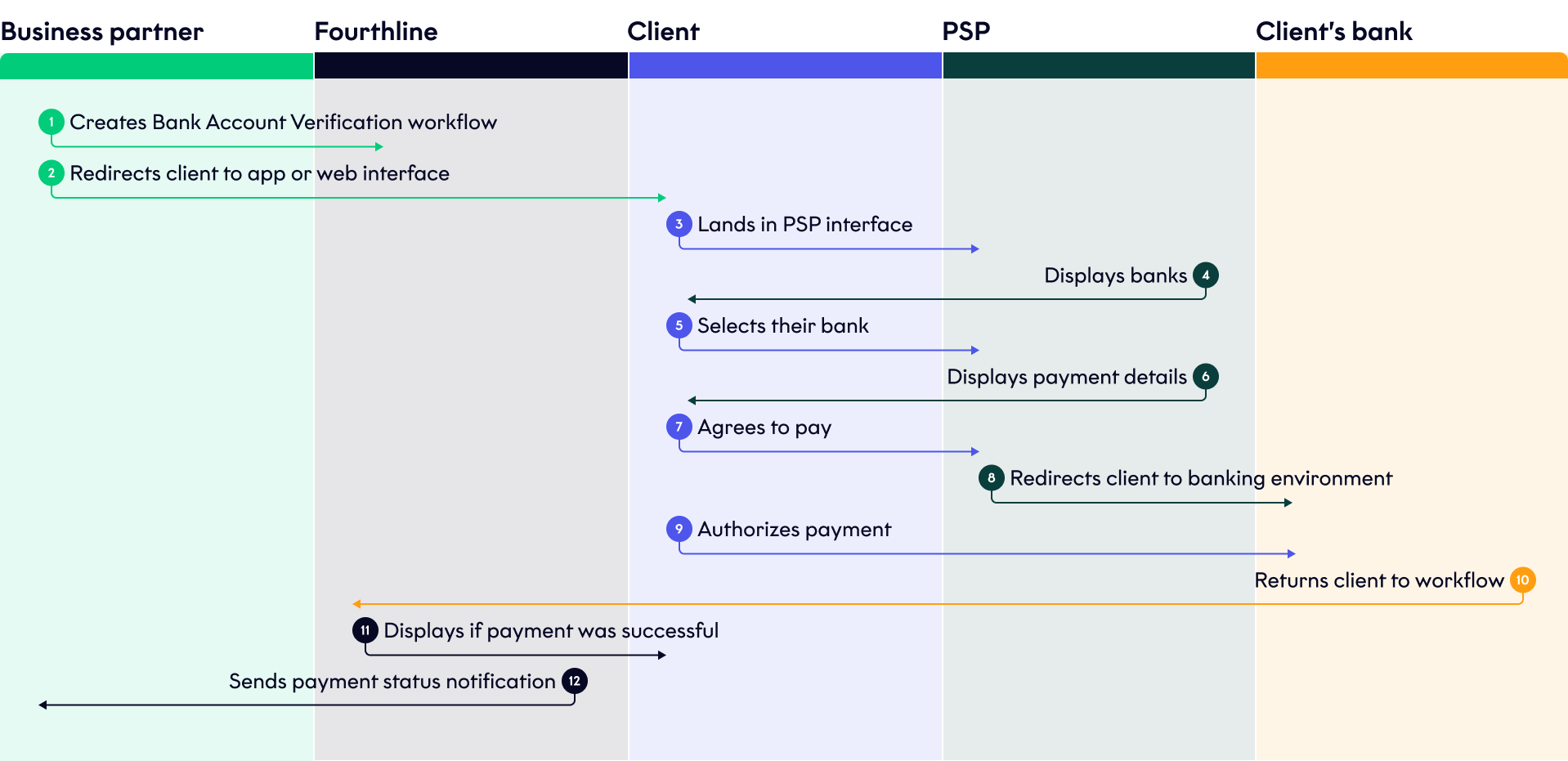

How it works

The flow is as follows:

Reference payment

The client starts the Bank Account Verification workflow.

Introduction screen

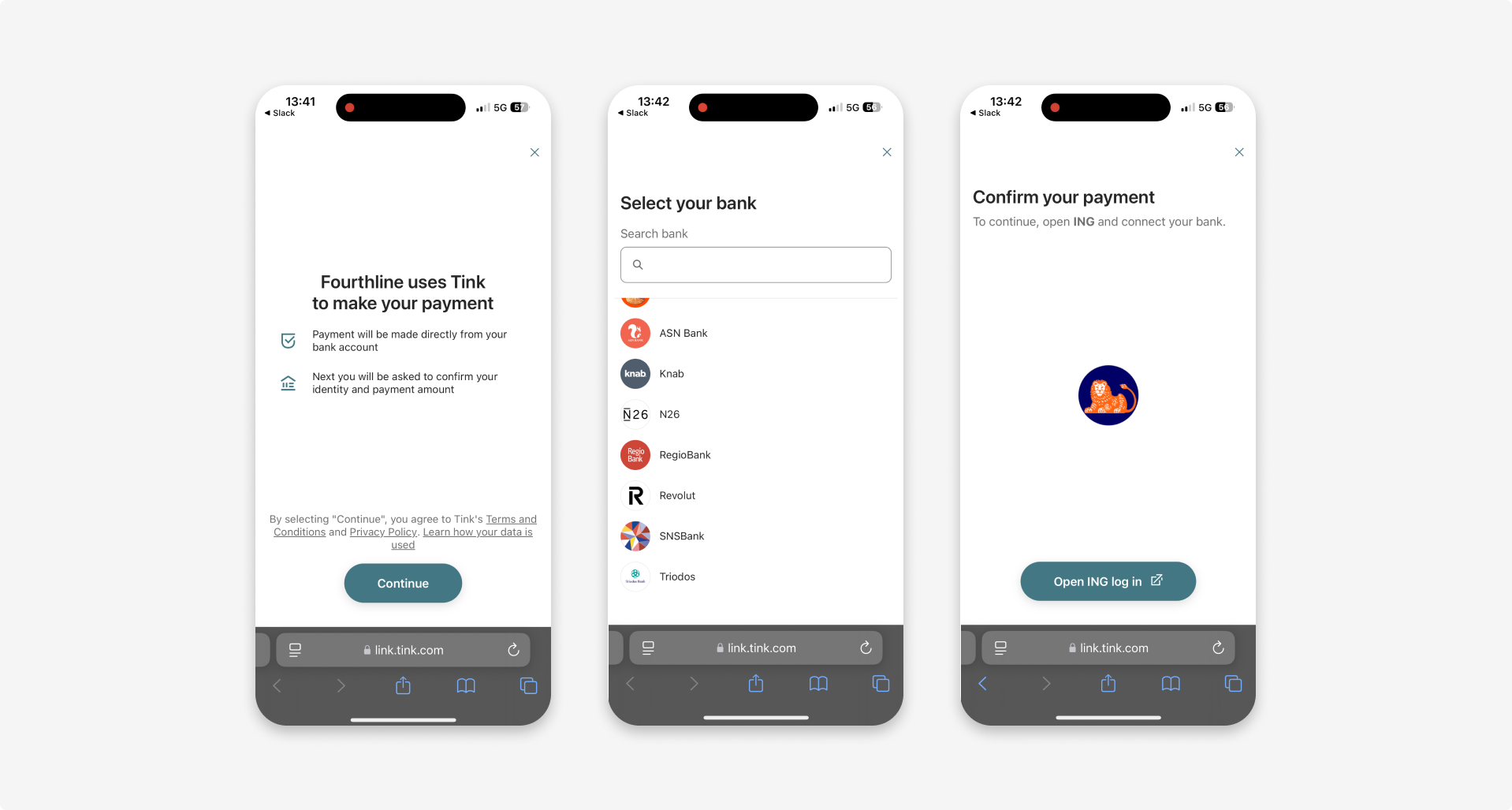

They are redirected to the PSP payment interface, where they select their bank. The PSP displays the payment details and the client agrees to pay.

Then, the PSP redirects the client to their banking environment, where they authorize the payment.

Tink payment interface

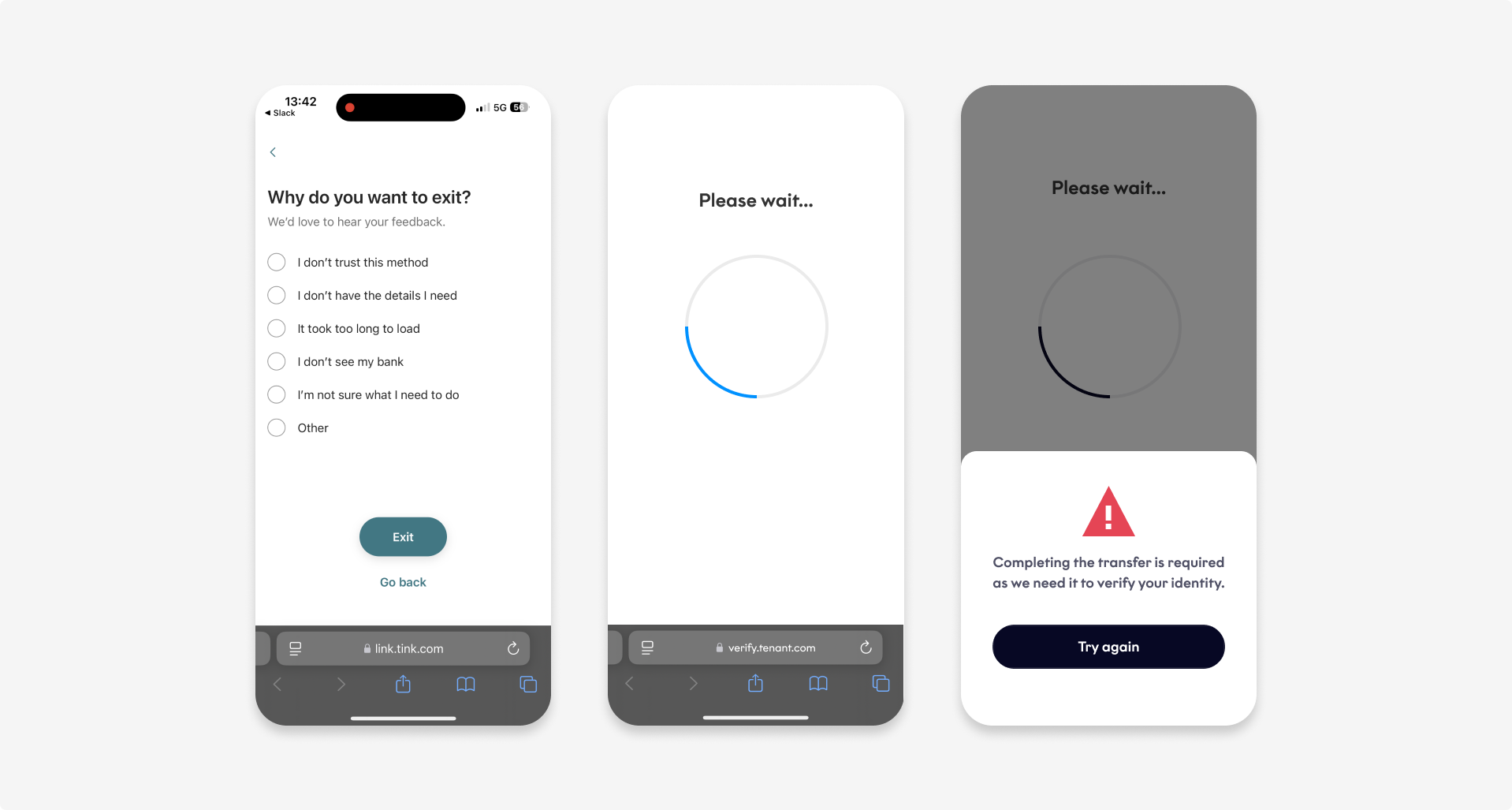

Tink errors

Payment confirmation

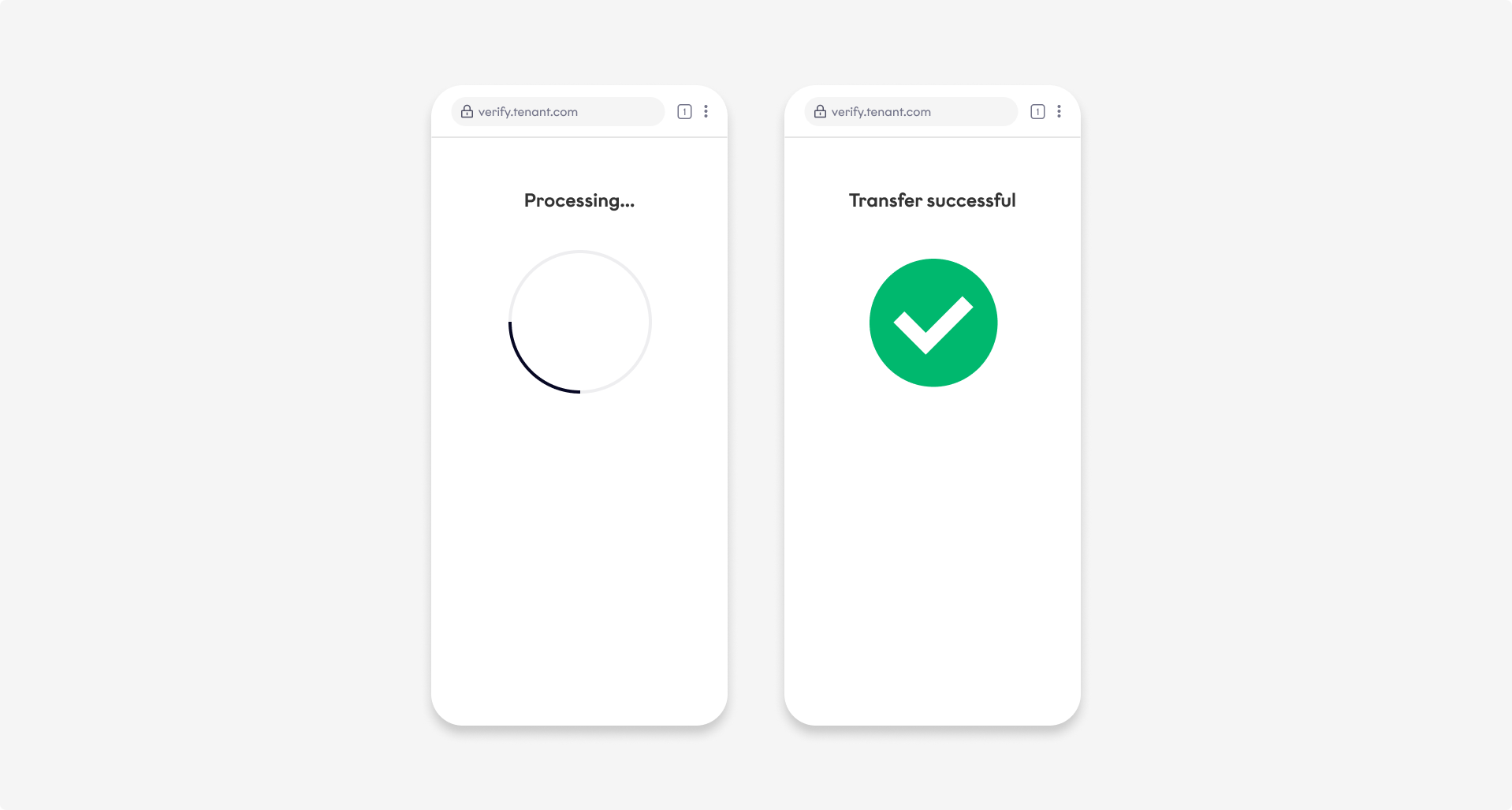

The client returns to the Bank Account Verification workflow and Fourthline displays if the payment was successful.

Payment confirmation

Updated 2 months ago