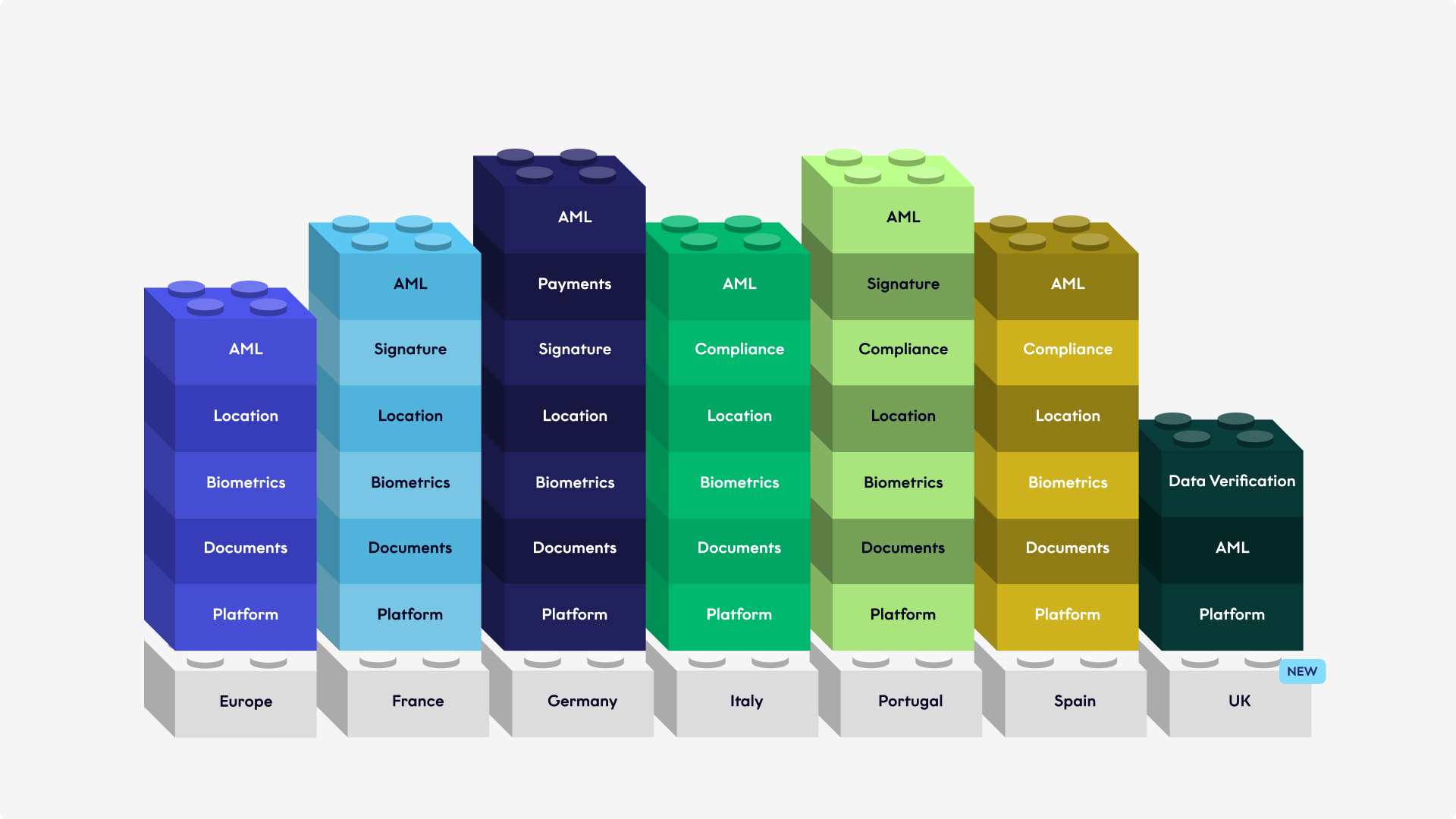

Identity Verification Solutions

Solutions overview

Combine Fourthline products into a remote Identity Verification solution to ensure clients are who they say they are when onboarding. Comply with local requirements across Europe and beyond.

Examples of locally compliant solutions include:

Click to magnify

You can also draw on our extensive, specialist knowledge of KYC and AML compliance regulations within Europe and beyond.

European solution

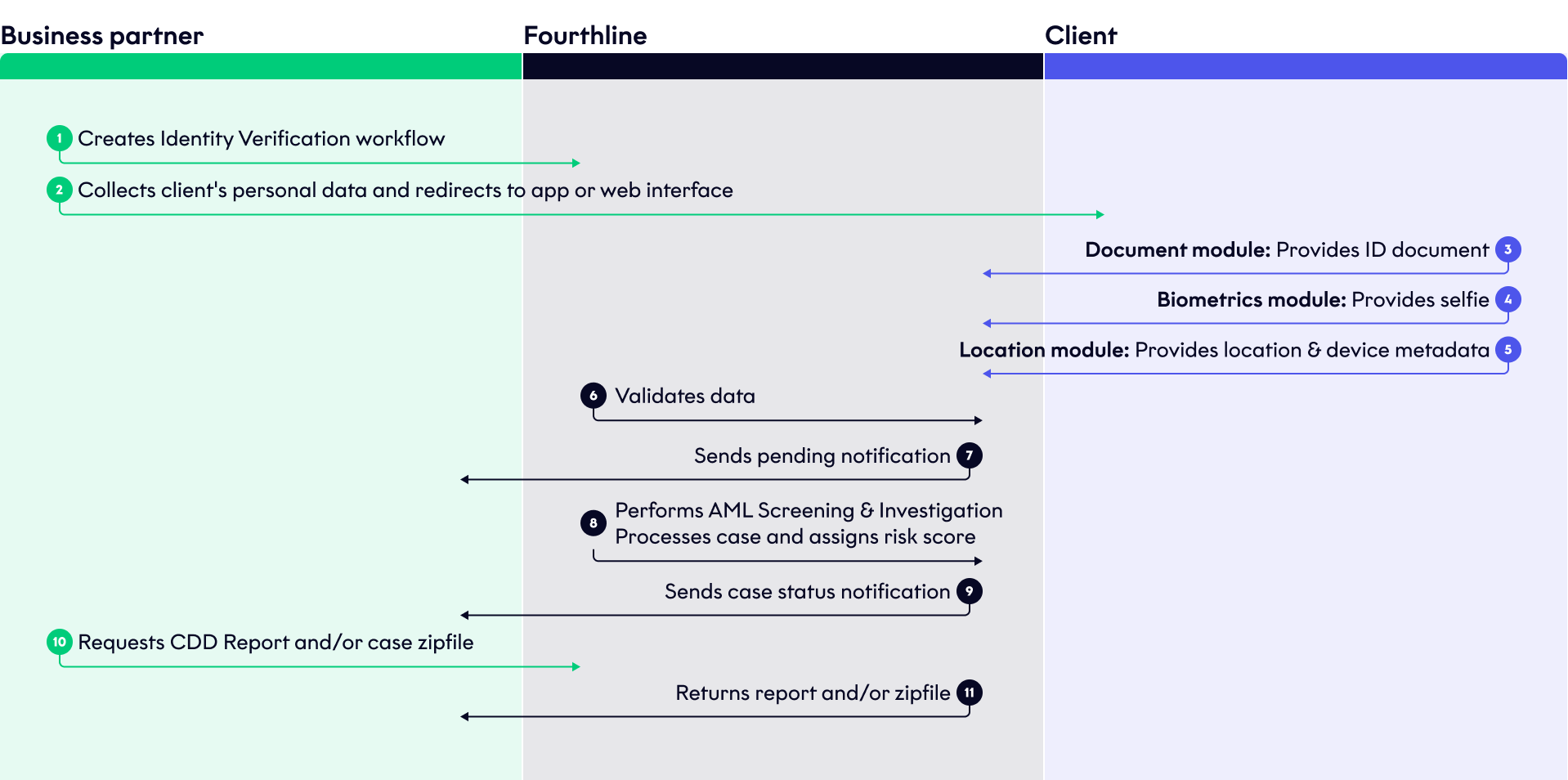

Our flagship European Identity Verification solution complies with the Dutch implementation of the 5AMLD: the Dutch Anti-Money Laundering and Anti-Terrorist Financing Act (Wet ter voorkoming van witwassen en financieren van terrorisme, Wwft). It is a proprietary, bank-grade, end-to-end solution with minimal friction.

The flow is as follows:

It comprises 3 client-facing modules, followed by case processing:

| Module | Description | Required |

|---|---|---|

| Document module | This module offers peace of mind that you are onboarding clients with valid, authentic, and uncompromised ID documents. If a client can't pass the document check for any reason, we provide clear reason codes for optimal user feedback. | |

| Document Photo | The client provides photos of their ID document and we verify that the document is fully visible and authentic and subsequently extract the document data. | |

| Document Liveness | We record a 10-second video of the ID document, and then and check any security features and that the document is authentic. | |

| Document NFC | We check if the NFC chip embedded in the ID document is authentic and uncompromised, and then extract and verify the data. | |

| Secondary Document | If required for local regulations, the client provides an additional ID document. | |

| Tax Number | If required, we capture the client's TIN and any other tax information from the relevant document. | |

| Biometrics module | This module analyzes the client’s facial traits to confirm they are the person they claim to be. If the client can't pass the selfie check for any reason, we provide clear reason codes for optimal user feedback. | |

| Selfie Photo | We perform a facial similarity check between a selfie of the client and the portrait on their ID document to confirm they are the document holder. | |

| Selfie Liveness | We record video of the client’s face as they turn their head left, then right to confirm they are a living human being who is physically and voluntarily participating. | |

| Selfie Audio | We record audio while the client takes the selfie photo and performs the liveness check. This helps detect fraud, e.g. a third party instructing or coercing the client. | |

| Location module | This module helps fight fraud by verifying a client's actual physical location and home address. | |

| Digital Proof of Address | We check if the geolocation and metadata of the client’s device are valid, authentic, and uncompromised, and then compare them to the home address provided by the client. | |

| Physical Proof of Address | We check that the home address provided by the client matches an uploaded official document stating their address, e.g. a utility bill, tax document. | |

| Geolocation | We check if the geolocation of the client’s device is valid, authentic, and not in a prohibited country. | |

| Case Processing | Fourthline then processes the case in our Case Review Portal. The case is first processed by our AI agent. Then if required, a human agent reviews it to perform additional anti-fraud and financial crime checks. | |

| AML Screening | Fourthline performs an AML screening and AML Investigation to check for the following hit types: • Sanctions • PEPs • Adverse media articles • Convictions • Sensitivity list | |

| Risk Score | Fourthline performs a risk assessment on the client using our proprietary logic and assigns them a risk score. | |

| CDD Report | When Fourthline has processed the case, you can download the detailed CDD Report via our API. | |

| Review & Audit | You can review all cases processed by Fourthline with Case Auditing and gain further insight via the Fourthline Dashboard. |

French solution

This solution complies with the French implementation of the 5AMLD: R. 561-5-2 1° and 6° of the French Monetary and Financial Code:

The flow is as follows:

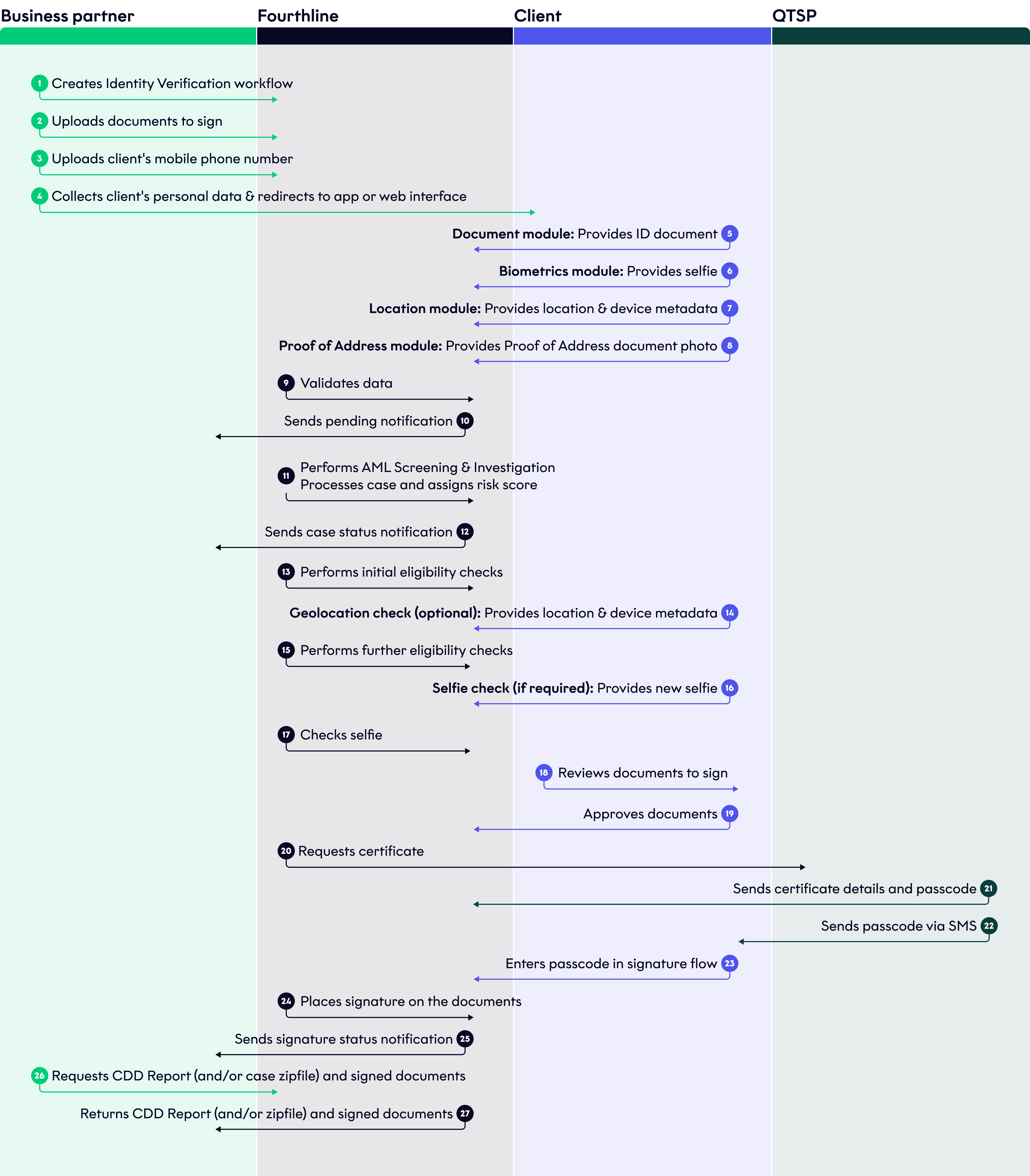

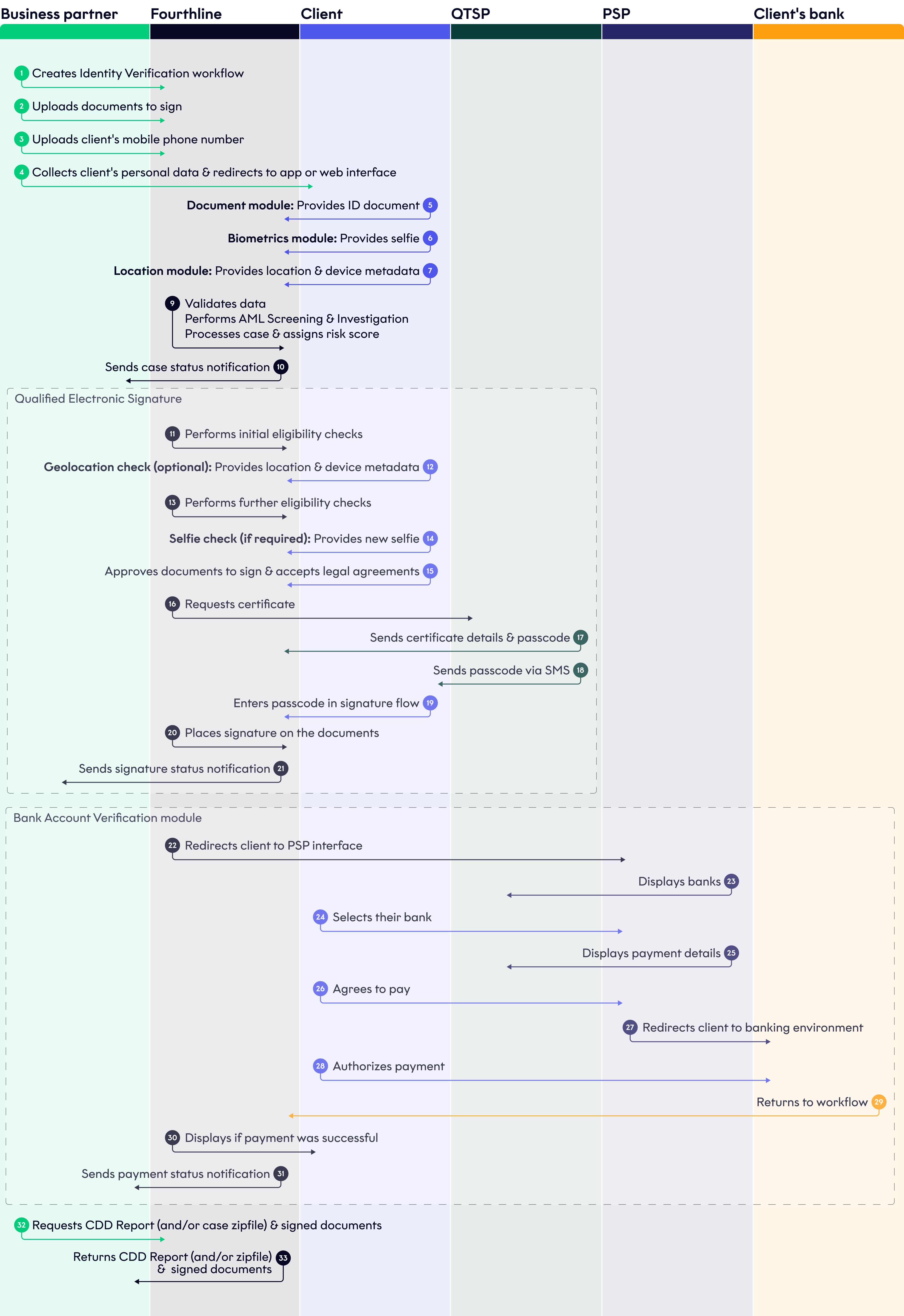

German solution

This solution complies with BaFin guidelines and the German implementation of the 5AMLD: the German Anti-Money Laundering Act (Geldwäschegesetz, GwG):

| Product | Required |

|---|---|

| European Identity Verification | |

| Document NFC | |

| Qualified Electronic Signature | |

| Bank Account Verification | |

| Case Auditing | BaFin recommended |

The flow is as follows:

Italian solution

This solution complies with the Italian implementation of the 5AMLD: Legislative Decree 231/2007 and meets Banca d’Italia requirements:

Portuguese solution

This solution complies with the Portuguese implementation of the 5AMLD:

- Law No. 83/2017 of August 18 on measures to combat money laundering and terrorism financing

- Notice 1/2022 of Bank of Portugal

Spanish solution

This solution complies with Sepblac regulations and the Spanish implementation of the 5AMLD: Law 10/2010 of 28 April :

| Product | Required |

|---|---|

| European Identity Verification | |

| Market-specific data: • Liveness selfie video (a video is used to determine the client's liveness) • Video geolocation (document video geolocation is present and matches the selfie video) • Document video (a video is used to ensure all sides of the ID document are shown) | |

| Document NFC | |

| Qualified Electronic Signature |

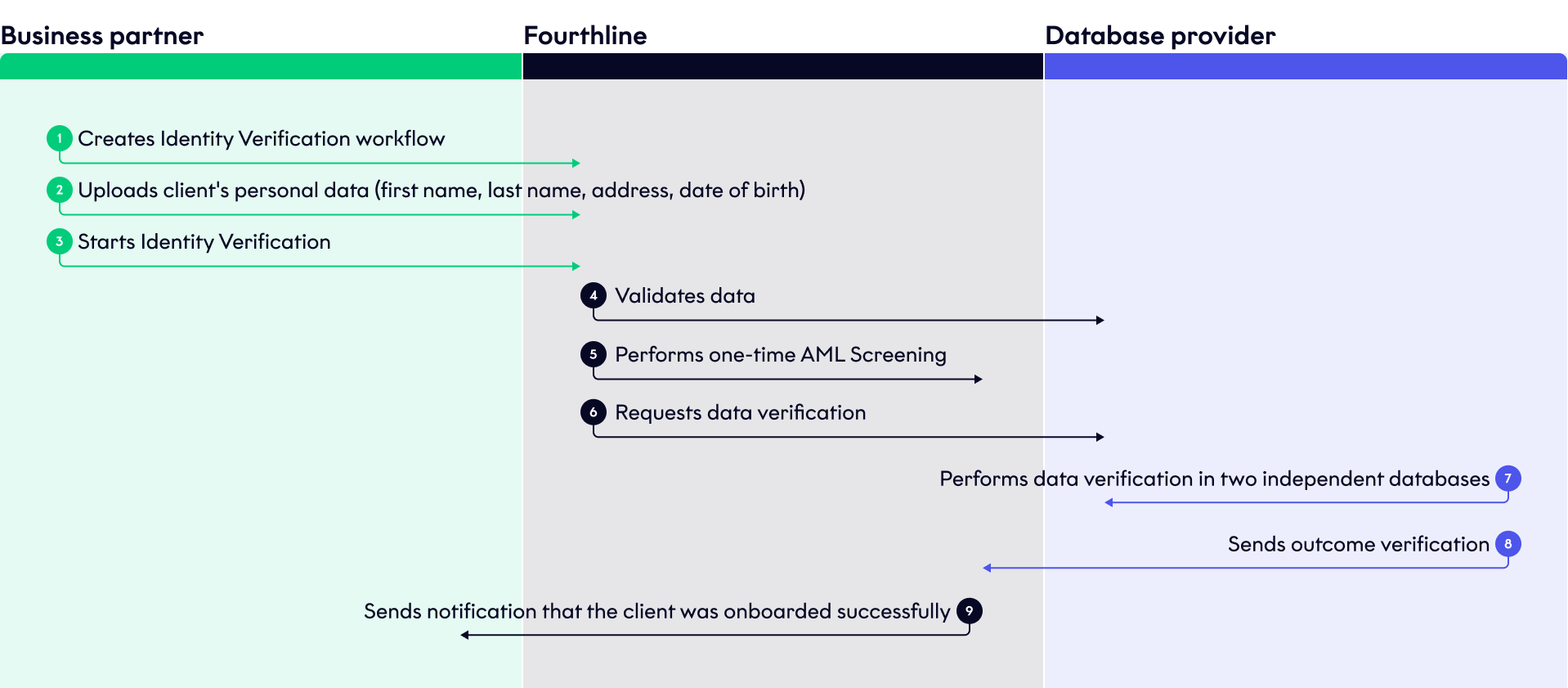

UK solution

This solution adheres to the guidance provided by the JMLSG and aligns with the international standards set by the FATF.

The UK solution is a bank-grade, lightweight onboarding solution designed to minimize user friction while adhering to the regulatory requirements.

| Product | Description |

|---|---|

| Data Verification | Fourthline verifies a client's identity by conducting a one-time AML screening and cross-referencing personal information against multiple databases, including government records, financial records, and public records. |

The flow is as follows:

Updated about 2 months ago